does nevada have an inheritance tax

To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on. However estates valued above 1206 million in 2022 are subject to a federal.

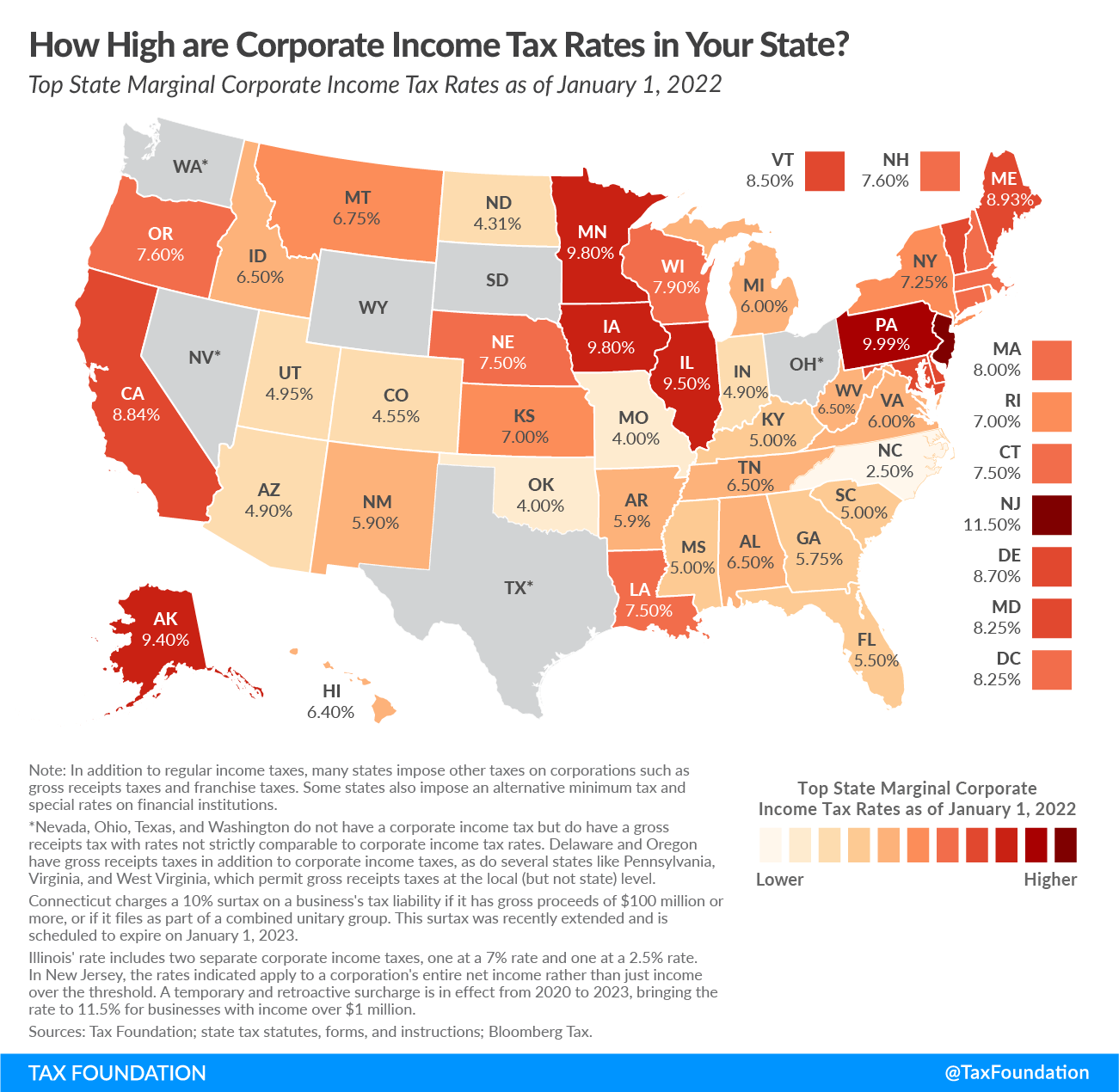

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Nevada also does not have a local estate.

. Nevada does not levy an inheritance tax. Nevada repealed its estate tax also called a pick-up. Each state has its own tax laws which govern taxation.

However the property tax rates in Nevada are some of the. Second if you have an heir that lives outside of Louisiana in a state that imposes an inheritance tax that heir might still be subject to that states tax. Does Nevada have property tax.

This means that you do not need to. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs. The sales tax In Las Vegas.

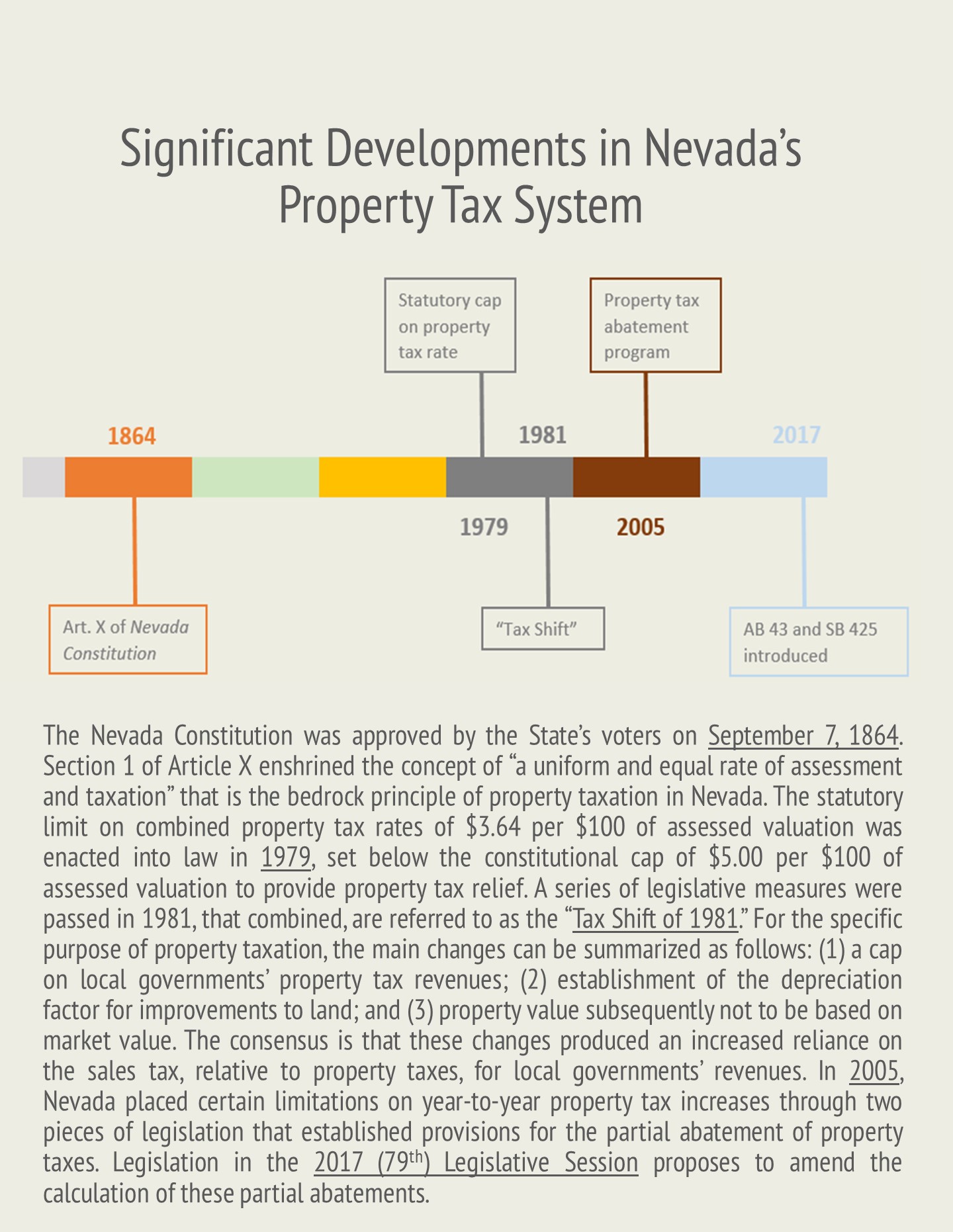

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. Property taxes in Nevada pay for local services such as roads schools and police.

Nevada Inheritance Tax and Estate Tax. But taxes are just one element of. States That Have Repealed Their Estate Taxes.

Nevadas average Property Tax is 77 National average is 119. It means that in most cases you wont be responsible for any tax due if you inherit property in Nevada. Under Nevada taxation laws there is no provision for inheritance and estate taxes.

Here are the answers to five common Nevada inheritance tax questions 775 823-9455. Heres a breakdown of each states inheritance tax rate ranges. It is one of the 38 states that does not apply an estate tax.

No Estate Tax Laws in Nevada. That is becasue an. Delaware repealed its tax as of January 1 2018.

Does Nevada Have an Inheritance or Estate Tax. Under Nevada law there are no inheritance or estate taxes. No Nevada does not apply an inheritance or estate tax.

Seven states have repealed their estate taxes since 2010. Property Tax In Southern Nevada is about 1 or less of the propertys value.

Moving From California To Nevada What You Should Know About Residency Income Tax And Estate Planning San Mateo San Francisco Reno Etchebehere Law Group

2021 State Business Tax Climate Index Tax Foundation

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Inheritance Tax Here S Who Pays And In Which States Bankrate

Nevada Retirement Tax Friendliness Smartasset

Nevada Last Will And Testament Legalzoom

Nevada Inheritance Laws What You Should Know

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

Relocating To Other Western States Could Impact Estate Tax Value Absolute Trust Counsel

Nevada No Income Tax Vintage Advertising Policy Postcard Flag Capitol 1940s Ebay

Do I Have To Pay Nevada State Business Income Tax

Nevada Estate Tax Everything You Need To Know Smartasset

Property Taxes In Nevada Guinn Center For Policy Priorities

First Centennial Title Company Of Nevada It S Time For Your Tuesdaytip There Are Many Reasons To Live In The Great State Of Nevada But Do You Know About Nevada S

Property Taxes In Nevada Guinn Center For Policy Priorities

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Capital Gains Tax In Nevada Archives Anderson Dorn Rader Ltd

.png)